Imagine that you are on a wildlife safari, cut off from the concrete jungles and the hectic pace of modern life. Would you expect to get insights about the world of stocks and investing? Sounds crazy right? But, think deeply and you might just make the connection. Nature and wilderness hold lessons that we can apply to the corporate jungle and the equity markets if you may. After all, it’s all about the survival of the fittest, is it not?

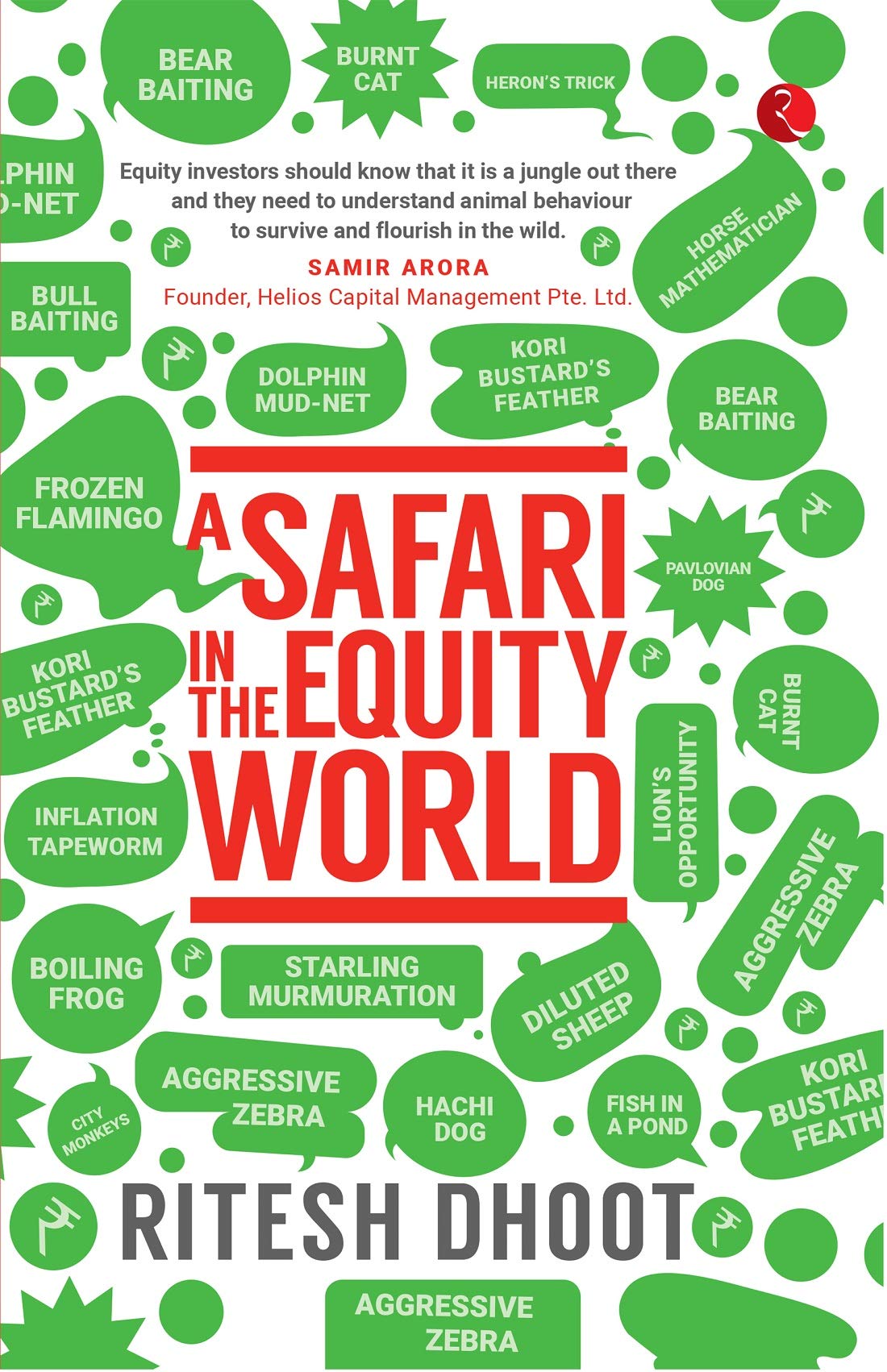

It was on one such trip to Kenya, that investment professional Ritesh Dhoot drew parallels between what he observed in the wilderness and some behavioural patterns of investors. In “A Safari in the Equity World”, published by Rupa Publications, he takes us on a ride through the investment jungle.

The book highlights some broadly defined themes that help investors make sound investment decisions. While most of his examples pertain to the Indian equity markets, the themes themselves have universal application and would be useful to investors in other countries as well.

Clearly, as the name suggests, the strength of this book lies in the varied and many analogies that it draws. There are analogies between animals, animal behaviour, hunting strategies etc on one hand, and the investor and market behaviour on the other. This is the soul of the book. In addition, Dhoot gives several examples from the world markets as well as Indian markets, which makes the content very relatable.

For me, a pleasant surprise was the first chapter that explained how some of the animal related terms that are often used in the market came to be. I quite appreciate this dip into the animal origins of financial expressions!

So, what are the animals whose traits you must adopt to be a successful investor? Does the majestic lion have anything to teach you about selection of stocks? The famed “Frozen Frogs and Frozen Flamingos” in nature, who appear dead when they are ‘frozen’ in winters, but spring back to life as the ice thaws have some pointers for us. Yes, they point to how people misperceive cyclical lows in some sectors, and thus do not invest in what otherwise could have been a good bet.

The hunting strategies of dolphins and whales create a situation where unsuspecting fish become victims, albeit in different ways. Similarly, people also get ‘trapped’ into wrong financial decisions of the desire for uncertainty aversion.

We often moan about the loss of natural habitat due to urbanization. But, as this book reveals, did you know that so many animal species have carved their comfort zone and niche in urban areas as well? And, they are probably faring much better than they would in the wild! Does this tell us anything about seeking greener pastures in the context of equity markets?

These are just some of the points that Dhoot addresses with the apt analogies! I think that one of the benefits of using analogies is that it makes something easy to remember. Hence, if you read the book and some of the analogies and their connections really strike a chord with you, rest assured that you will remember it forever!

My favourite analogies in the book were those of the different hunting tricks of predators and the application of these to the equity market! Well, survival of the fittest is the name of the game so I guess these examples are the most apt ones and hold some really crucial takeaways for readers!

Along with animal references, there is also a lot of psychology that creeps in. Fair enough, since you can never really talk about the equity market without talking about the thinking, perception and bias that influences people to take the decisions that they do.

A Safari in the Equity World gives us a new way of looking at the financial world and the equity markets. This refreshingly different point of view brings in fresh perspectives and add value to your decision making.

Well, maybe it’s time to hop on for a safari ride in the financial jungle! Are you ready for a sojourn in the wild?

Books on investment